New Delhi: In a move aimed at advancing India’s business environment and insolvency resolution framework, Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman presented the Union Budget for 2024-25 in Parliament today. The budget emphasizes a commitment to fostering economic growth through significant reforms and digitalization.

Incentives for Business Reforms

To enhance the ease of doing business across the country, the Finance Minister announced a new initiative to incentivize states for their implementation of Business Reforms Action Plans and digitalization efforts. This aligns with the ongoing Jan Vishwas Bill 2.0, which aims to simplify and streamline business processes.

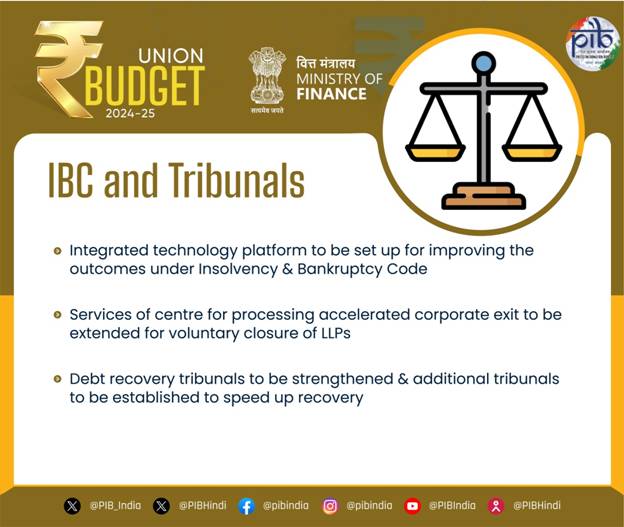

Strengthening the Insolvency and Bankruptcy Code (IBC)

A major highlight of the budget is the proposal to establish an Integrated Technology Platform to optimize the Insolvency and Bankruptcy Code (IBC). This platform is expected to enhance the consistency, transparency, and efficiency of insolvency proceedings, ensuring better outcomes for all stakeholders involved.

Smt. Sitharaman revealed that the IBC has successfully resolved over 1,000 companies, resulting in a direct recovery of more than ₹3.3 lakh crore for creditors. Additionally, 28,000 cases involving over ₹10 lakh crore have been resolved before admission. To further bolster this system, the budget proposes reforms and strengthening of both the tribunals and appellate tribunals to expedite insolvency resolutions. The creation of additional tribunals, including some dedicated exclusively to the Companies Act, is also on the agenda.

Facilitating Voluntary Closure of LLPs

The budget also outlines plans to extend the services of the Centre for Processing Accelerated Corporate Exit (C-PACE) to cover the voluntary closure of Limited Liability Partnerships (LLPs). This extension aims to streamline the closure process and reduce the time required for dissolution.

Enhancing Debt Recovery Mechanisms

Furthering efforts to improve debt recovery, the budget proposes reforms and the establishment of additional Debt Recovery Tribunals. These measures are designed to expedite the recovery process, offering a more efficient path for creditors seeking to reclaim owed funds.

The Union Budget 2024-25 reflects the government’s dedication to creating a more robust business environment and a streamlined insolvency resolution system. Through these initiatives, the administration hopes to lay the foundation for sustainable economic growth and a more efficient business landscape.