New Delhi: Union Finance MinisterNirmala Sitharaman, while presenting the Union Budget 2026–27, announced a series of forward-looking measures aimed at accelerating the growth of India’s Electronics and Information Technology sector, reinforcing its role as a key driver of economic expansion, innovation and global competitiveness.

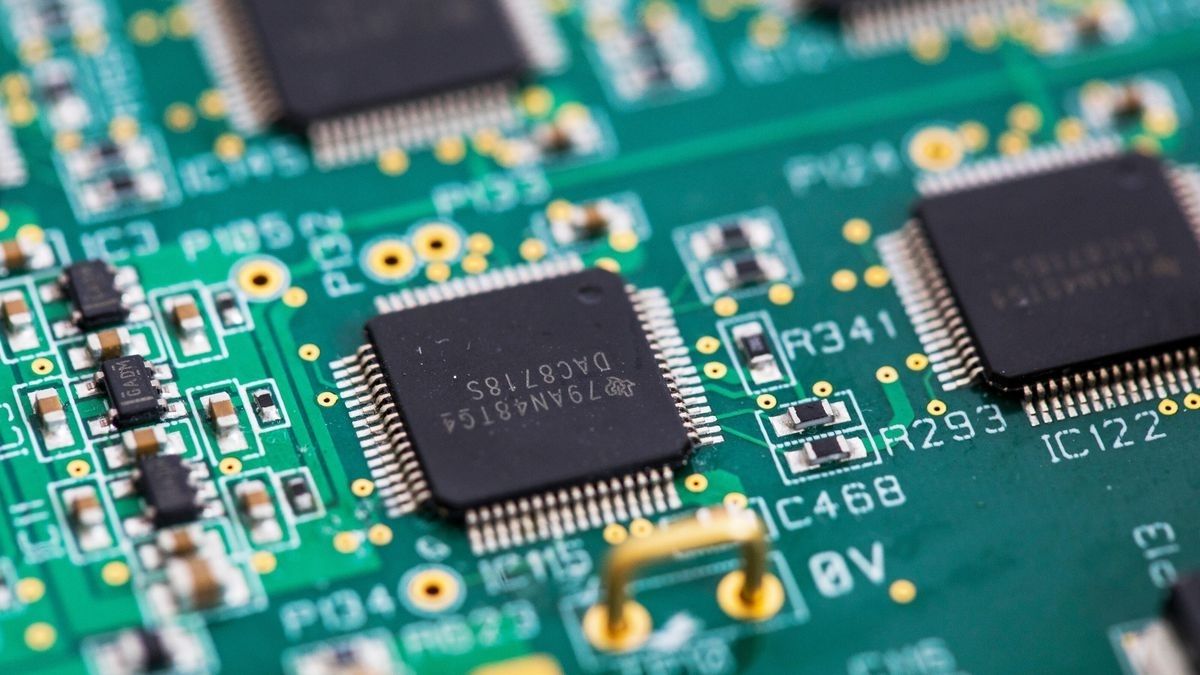

A major highlight of the Budget is the launch of India Semiconductor Mission (ISM) 2.0, which seeks to deepen India’s semiconductor ecosystem by promoting domestic production of equipment and materials, developing full-stack Indian intellectual property, and strengthening global supply chains. The mission will emphasise industry-led research and training centres to build advanced technologies and a skilled workforce. An allocation of ₹1,000 crore has been made for ISM 2.0 in FY 2026–27, building on the progress achieved under ISM 1.0.

To further capitalise on India’s growing electronics manufacturing momentum, the Budget proposes a significant expansion of the Electronics Components Manufacturing Scheme (ECMS). Launched in April 2025, the scheme—initially designed with an outlay of ₹22,919 crore—has already attracted investment commitments at nearly double the targeted level. In view of this strong response, the Government has proposed to enhance the scheme’s outlay to ₹40,000 crore, providing a major boost to domestic component manufacturing and value-chain integration.

Recognising the IT sector as a core growth engine of the Indian economy, the Budget introduces measures to provide greater tax certainty and ease of compliance. New safe harbour provisions for IT and IT-enabled services (IT/ITeS) have been proposed, with higher thresholds and competitive margins. Acknowledging the interconnected nature of software development, IT-enabled services, knowledge process outsourcing and contract R&D, the Budget proposes to club all these activities under a single category—Information Technology Services—with a common safe harbour margin of 15.5 per cent.

The threshold for availing safe harbour benefits has been substantially increased from ₹300 crore to ₹2,000 crore, significantly expanding the coverage for IT companies. Applications under the safe harbour regime will be processed through an automated, rule-driven mechanism, eliminating the need for examination by tax officers. Companies opting for the safe harbour will also be allowed to continue under the same framework for five consecutive years, providing long-term certainty.

For firms seeking Advance Pricing Agreements (APAs), the Budget proposes to fast-track the unilateral APA process for IT services, with an endeavour to conclude agreements within two years, extendable by six months at the taxpayer’s request. The facility of modified returns available to entities entering APAs will also be extended to their associated enterprises.

To promote investment in critical digital infrastructure, the Budget announces a tax holiday till 2047 for foreign companies providing global cloud services using India-based data centres, subject to routing services to Indian customers through Indian reseller entities. Additionally, a 15 per cent cost-based safe harbour has been proposed where data centre services are provided by related entities, further enhancing investor confidence.

In a move aimed at aligning education, skills and employment with the evolving services economy, the Budget also proposes the formation of a High-Powered ‘Education to Employment and Enterprise’ Standing Committee. The committee will recommend measures to strengthen the services sector as a key pillar of Viksit Bharat, while assessing the impact of emerging technologies, including Artificial Intelligence, on jobs and skill requirements.

Bhubaneswar: In a landmark initiative aimed at transforming the educational journey of girls from disadvantaged…

Bhubaneswar: Signalling a strong thrust on growth, welfare and infrastructure, Chief Minister Mohan Charan Majhi…

Bhubaneswar: Admissions to the 4-Year Integrated Teacher Education Programme (ITEP) in Odisha for the academic…

Bhubaneswar: Emphasising that Lord Shree Jagannath is the supreme spiritual landlord of the Odia community,…

Bhubaneswar: The Annual High School Certificate (HSC) Examination 2026 began across Odisha on Wednesday, with…

Bhubaneswar: Sanatanpali, a quiet village under Jujumara block in Odisha’s Sambalpur district, today wears a…